Non-Profit Public Charity

DISCLAIMER: Not Tax Advice

No portion of this website or any communication may be considered tax advice. We merely document the organizations’s tax status based upon our filings with the appropriate authorities.

Taxes are extremely complicated and affect people differently based upon many factors that we can not know. Therefore, please contact your accountant or tax adviser concerning how a donation would affect you.

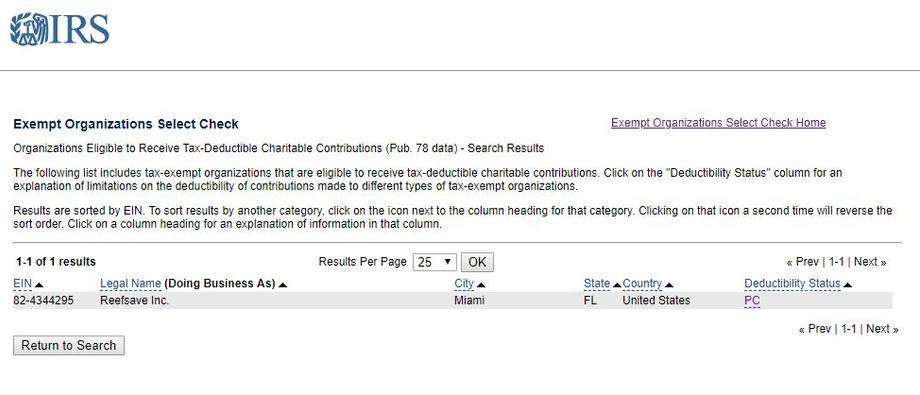

This page verifies that ReefSave Inc is a public charity, and provides a basic explanation of the charitable deduction for U.S. taxpayers. For non-cash donations, the value for “in kind” donations can vary depending upon what the charitable organization does with the “in-kind” donation.

If the organization sells the donated item or service, then the amount realized by the organization becomes the value the donor would use. However, if the organization uses the item in its mission, then the donor sets the fair market value for tax purposes

What is a 501(c)(3) Organization?

ReefSave Inc is a public tax exempt not for profit organization under section 501(c)(3) of the Internal Revenue Code. That means U.S. taxpayers may deduct on their U.S. income tax returns, monetary donations made to the organization. Since tax rates vary depending upon may factors, you should contact your accountant for a calculation of what the tax savings would be for you.

What does 509(a)(2) donation mean?

There are different types of 501(c)(3) tax exempt organizations. ReefSave Inc is classified as a 509(a)(2) organization which means it is publicly supported and collects a significant portion of its donations in the form of admission fees for attendance or participation.

Types of Volunteers and Charitable Deductions

The IRS recognizes that some volunteers may be eligible to deduct their unreimbursed travel and related activity expenses as charitable deductions. This is explained in IRS Publication 526

In general, if you volunteer some of your time at the 2018 Bequia Lionfish Trap Testing Project for ReefSave.org, while your work contribution is welcomed and appreciated by all, your expenses are unlikely to qualify as deductible charitable expenses.

However, if you volunteer to become a full time commissioner, and accept responsibility for certain tasks and duties during the time of your commission, then your expenses are likely to qualify as deductible charitable expenses.

State of Florida

Division of Consumer Services

REEFSAVE INC

REGISTRATION NUMBER: CH54370

EXPIRATION DATE:March 3, 2020